M&A

Fundamentals

Mastery

Learn the fundamentals of Mergers & Acquisitions that you'll need to understand to nail your IB interviews

Read reviews from students who have completed this course.

Mike's way of teaching is unparalleled. His ability to simplify difficult concepts with ease has really helped me understand mergers and acquisitions within ...

Read MoreMike's way of teaching is unparalleled. His ability to simplify difficult concepts with ease has really helped me understand mergers and acquisitions within such a short time span.

Read LessThank you Mike for introducing me to M&A in the most fun and engaging way!

Thank you Mike for introducing me to M&A in the most fun and engaging way!

Read LessThis module is taught in a way that a student to learn and understand the course.

This module is taught in a way that a student to learn and understand the course.

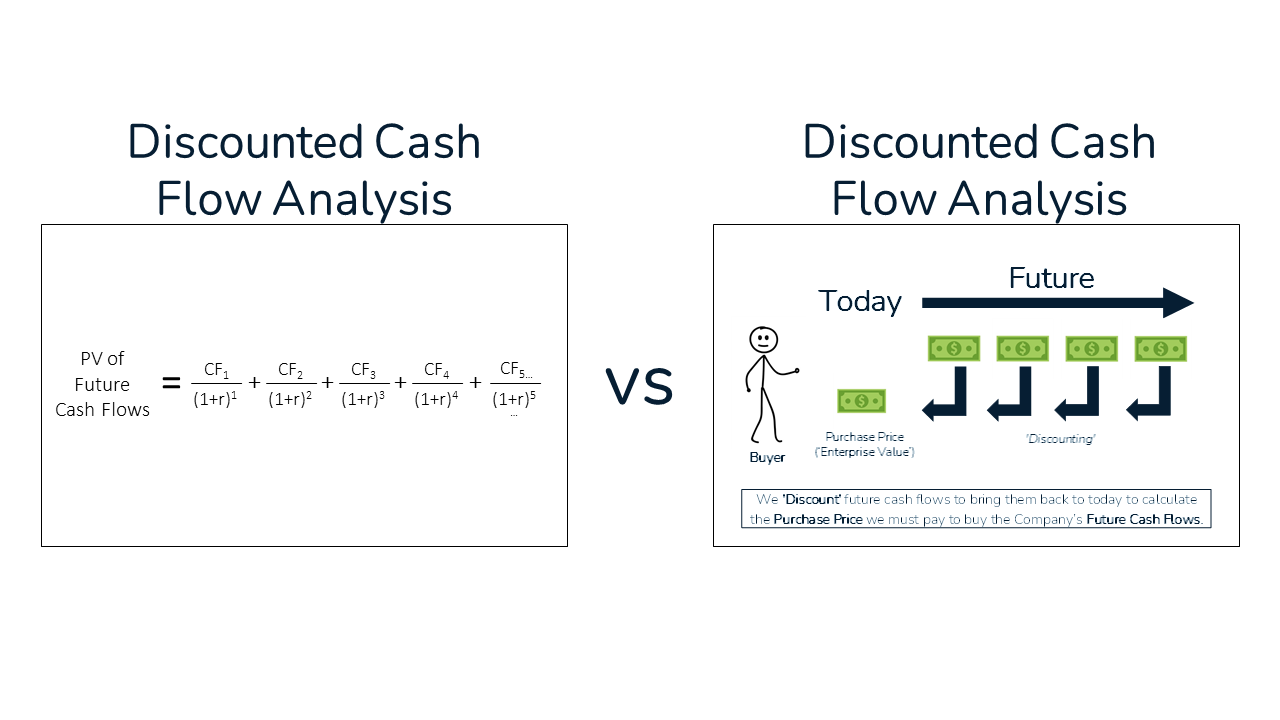

Read LessWe use a highly visual approach to make concepts easier to digest.

What is a 'Sell-Side' in M&A?

A Visual Example of Accretion/Dilution

Total Course Time: 1 Hour & 34 Minutes

Intro to Accretion/Dilution (5 Min)

M&A Benefits & Costs (8 Min)

The Accretion Dilution Formula (3 Min)

All Stock Accretion/Dilution Examples (10 Min)

Time for Excel: Accretion/Dilution - All Stock (5 Min)

How are you feeling?

Take a Breather (3 Min)

Incorporating Debt & Cash (10 Min)

Time for Excel: Accretion/Dilution - Yield Approach (7 Min)

Burn it in! (9 Min)

Test Your Skills!

Stock Deals vs Asset Deals (5 Min)

Key Concepts & Summary View (10 Min)

Burn it in! (2 Min)

Test Your Skills!

Wrap-Up (37 Sec)

Additional Resources

How are you feeling? - End of Course

Learn from a former Investment Banking, Private Equity, and Hedge Fund practitioner (and Columbia Business School professor) who has successfully trained thousands of students.

Mike has accumulated a unique range of experiences as a practitioner and teacher across the core areas of top-tier Finance.

In Finance|able's courses, Mike ties these experiences together to help students see each situation from buy-side, sell-side, and operating roles using time-tested methods from over a decade and a half working and teaching on Wall Street.

Mike oversees all curriculum development and is building the only curriculum available that is purpose-built to tie together the common threads across disciplines above to maximize your potential as an analyst.

Coming from a non-traditional background, our Founder, Mike Kimpel, is incredibly passionate about helping newcomers learn about (and excel in!) the world of Finance!

You will be able to succeed whether you're headed to Investment Banking, Private Equity, Investment Management, Corporate Finance, or M&A.

You'll learn to be much more than a 'Monkey' with our training.

Learn Effortlessly With Our Intuitive, Visual Approach

Many finance courses look like a copy-paste from a textbook to a slide.

Let's face it, nobody likes learning this way...especially not in 2022.

Our courses are designed with a highly-visual approach to help make learning easier, more engaging...and call us crazy...but even a little bit fun!

To quote an early user:

"when you mentioned that there's nothing out there like this, I thought you meant you just had a better understanding of accounting than others, but the financeable platform is actually one of a kind. The mini quizzes and visuals are amazing and they're a perfect way to learn."

Zero Time Wasted!

You're a busy person, with a lot on your plate!

We skip the fluff and zero in on what you really need to know!

As an example, many Excel courses teach you every Excel Function under the sun.

In contrast, our Excel Survival Kit focuses on what you'll actually use day-to-day as an analyst.

And our Excel course is built around a comprehensive project that actually reflects what you will actually do on the job!

We continue to be baffled by financial analyst programs that boast about 10-20+ hours of content...in a world where attention spans are shrinking by the minute.

It reminds us of the famous Mark Twain Quote:

“I apologize for such a long letter - I didn't have time to write a short one.”

Don't worry, you won't need 20+ hours to learn core topics with our courses!

Ace Any Task with our Dynamic Frameworks

Most intro-level modeling courses are built around a particular company case.

This sounds like a great idea, but it has two major issues:

While we will offer real-company cases, our foundational courses are built around a simplified example to ensure you build a strong conceptual foundation.

We further reinforce your learning with Visual Mental Maps for everything from Valuation to Financial Modeling.

With our courses and mental maps, you will be able to attack any model with confidence instead of getting lost in one-off nuances of individual companies. You won't get lost in the weeds in our courses!

Prep For Interviews Within The Course

Within each section of our Concepts courses (and LBO Modeling), you'll find a walkthrough of common interview questions tied to the concepts covered.

With this approach, we not only help you build a strong conceptual foundation but also prepare you to nail your interviews.

No More Information Overload!

Our courses are designed to deliver exactly what you need, based on where you are in your career progression.

We know your foundational training is only the beginning.

And we build our courses to provide you with exactly what you need at every stage of your learning journey.

In the end, we're aiming to provide you with everything you need to survive your first 5-10 years on the job.

Add your email to the mailing list to get the latest updates.